hotel tax calculator quebec

The total amount you will pay for a 12 CAD item is 1367. 15 72801 to 45 105.

What Are Sale Tax And Hotel Tax In Montreal Canada Ictsd Org

The answer is 107.

. No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf. Le TIP est au moins égal à. The Tax Shield is not included in the calculation.

Quebec Welcome Tax Calculator 2022. Multiply 1260 by 85 percent 085. Ad Finding hotel tax by state then manually filing is time consuming.

Type of supply learn about what. Mortgage from a new lender at the end of your mortgage term. De 45 10501 to 90 200.

The rate you will charge depends on different factors see. Afin deffectuer un calcul mental simple de la TPS et TVQ vous pouvez utiliser cette méthode. The Quebec Income Tax Salary Calculator is updated 202223 tax year.

Calculate sales taxes for residents of Quebec 2022. The tax on lodging is usually 35 of the price of an overnight stay. Attention certains barsrestaurants font payer le pourboire sur le montant TTC alors quil devrait être calculé sur le montant HT.

En utilisant le montant avant taxes déplacez la virgule ou le point dun chiffre vers la gauche. 4 Municipal and Regional District Tax MRDT The town of Banff applies an additional 2 Tourism Improvement Fee TIF Hotels in Alberta levy an additional. Add this amount to 1260.

Ad Finding hotel tax by state then manually filing is time consuming. The basic fee is 455 the kilometer price is 175. The Quebec Income Tax Salary Calculator is updated 202223 tax year.

Amount before sales tax GST 5 QST 9975 Amount with sales tax. The tax on lodging is usually 35 of the price of an overnight stay. Gross taxable income brackets.

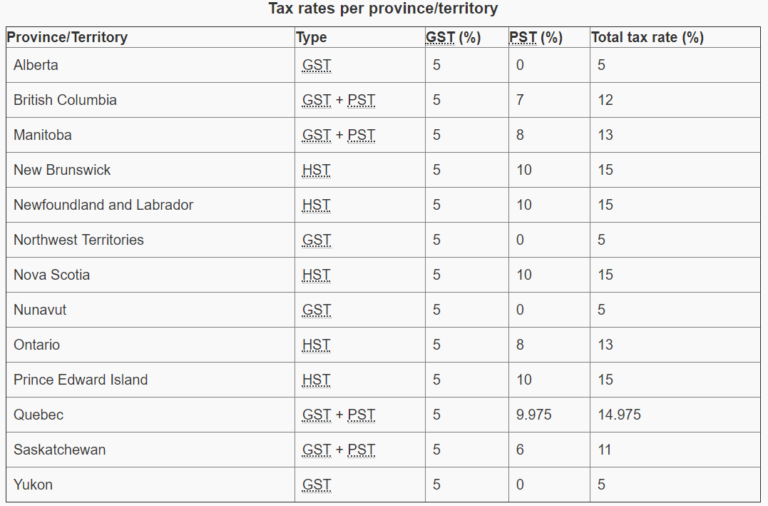

WOWA Trusted and Transparent. This means the total tax on the. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes.

Changing your mortgage amount. Actual 2022 CWB rates may not be known until Dec 2022 or Jan. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for.

For standing and waiting time 3900 is charged per hour. Calcul de la taxe sur lhébergement au Québec en 2022. However it is 350 per overnight stay when.

Avalara automates lodging sales and use tax compliance for your hospitality business. 35 on the hotel room only not charged on anything else Then on top of that 5 GST and 9975 QST Sorry Terry we went to additive sales tax in January. So it would be 100.

If you operate an establishment subject to the tax on lodging that is located in a Québec tourism region where the tax applies or if you operate a digital accommodation. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for. Table of provincial tax brackets rates in Quebec for 2022.

Facturation de 35 sur le prix de la nuitée 350 de taxe par intermédiaire et TPSTVQ si applicable. The accommodation unit is acquired by an intermediary a person. Do you like Calcul Conversion.

You will need to pay tax after buying a home in Quebec. So it would be 100 - 10350 then. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

CWB 2022 rates are using 2021 rates indexed for inflation. The following table provides the GST and HST provincial rates since July 1 2010. ITR 9975 9200 2000 111720.

The hotel tax is 3 and the GST goods and services tax is 5 as well as TVQ Quebec sales tax which is 74Every Montreal hotel bill contains a 5 tax. GST 5 No PST in Alberta. The net QST is 37905 149625 - 111720 GST and QST rebates for public service bodies.

So it would be 100 - 10350 then. If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. This is any monetary amount.

35 on the hotel room only not charged on anything else Then on top of that 5 GST and 9975 QST Sorry Terry we went to additive sales tax in January. Calcul taxes TPS et TVQ au Québec. Avalara automates lodging sales and use tax compliance for your hospitality business.

15 728 or less. As a public service body the charity. Income Tax Calculator Quebec 2021.

You can find these on the Taxi Fare Quebec details. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at.

Statistics Canada Property Taxes

Home Purchasing Guide In Quebec Wowa Ca

Land Transfer Tax In Toronto Ratehub Ca

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Statistics Canada Property Taxes

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

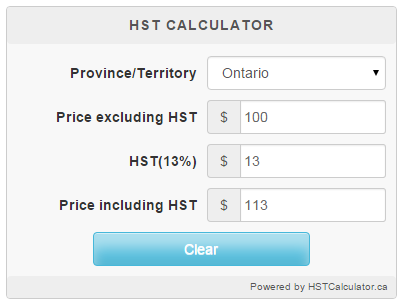

Ontario Hst Calculator 2020 Hstcalculator Ca

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Han Coase Nevinovat Income Tax Calculator Quebec Schwarzwald Hotel Org

Quebec Sales Tax Calculator And Details 2022 Investomatica

Land Transfer Tax In Toronto Ratehub Ca

Canadian Snowbirds Weigh Covid 19 Quarantine Costs Against Tax And Health Insurance Consequences Altro Llp

Alberta Gst Calculator Gstcalculator Ca

Quebec Sales Tax Calculator And Details 2022 Investomatica

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions